georgia ad valorem tax trade in

This tax is computed by multiplying the assessed value of the property by the millage rate applicable to each property. The State of Georgia does not register or title the following vehicles.

Slavery Descendants In Coastal Georgia Communities Fight Tax Hikes Threats To Their Ancestral Homes African Culture Black Culture Culture

Ad valorem tax fee provisions of OCGA.

. If the vehicle is currently in the TAVT system the family member can pay a reduced TAVT rate of 5 of the fair market value of the vehicle. Retail selling price is defined to include the sales price plus any fees. A reduction is made for the trade-in.

You can calculate the Title Ad Valorem Tax by finding the fair market value of the vehicle and multiplying it by 66. Effective October 1 2021 through December 31 2021 2208 KB General Rate Chart - Effective July 1 2021 through September 30. In effect since 2013 and the TAVT replaces the sales tax and the annual ad valorem property tax.

Sales Tax States shows that the lowest tax rate in Georgia is found in Austell and is 4. 2021 Employers Tax Guidepdf 178 MB Department of Revenue. Owners of vehicles that fit this category can use the DORs Title Ad Valorem Tax Calculator tool to calculate their.

As of 2018 residents in most Georgia counties pay a one-time 7 percent ad valorem tax on these vehicles at the time of purchase. The tax must be paid at the time of sale by Georgia residents or within six months of establishing residency by those. Accordingly the fair market value for a used motor vehicle for purposes of TAVT will generally be the same as the value that was used in the old annual ad valorem tax system.

In 2013 Georgia created the. The Title Ad Valorem Tax TAVT or Title Fee was passed by the 2012 Georgia General Assembly with additional amendments made during the 2013 legislative session. Georgia Motor Vehicle Forms are available at.

Payment of the TAVT provides an exemption from sales tax on the motor vehicle and the purchaser will also be exempt from the annual ad valorem tax or. Vehicles purchased on or after March 1 2013 and titled in Georgia are subject to Title Ad Valorem Tax TAVT and are exempt from sales and use tax and the annual ad valorem tax. TAVT is a one-time fee that replaces the sales tax and the annual ad valorem tax often referred to as the birthday tax on motor vehicles.

Cash discount and trade-in when the sale is from a dealer. How to Calculate Georgia Tax on a Car. You would pay 66 on the 40000 amount not the 45000 you paid.

An owner may contest the fair market value of a motor vehicle for purposes of state and local title ad valorem tax fee by filing an appeal as outlined in ocga. How is ad valorem tax calculated in GA. Use Ad Valorem Tax Calculator.

You will now pay this one-time. This tax is based on the value of the vehicle. For example imagine you are purchasing a vehicle for 45000 but the fair market value is 40000.

House Bill 386 was passed by the 2012 Georgia General Assembly and provided for a new method of taxation for certain motor vehicles effective March 1 2013. Georgia Ad Valorem Tax Trade In. House Bill 266 was passed by the 2013 session of the Georgia General Assembly and amended numerous aspects of House Bill 386.

Thereafter exempt from annual ad valorem tax. Motor vehicle dealers should collect the state and local title ad valorem tax fee TAVT from customers purchasing vehicles on or after March 1 2013 that will be titled in Georgia. New residents to Georgia pay TAVT at a rate of 3 New Georgia Law effective July 1 2019.

Georgia Tax Center Help Individual Income Taxes Register New Business. This value is calculated by averaging the current wholesale and retail values of the motor vehicle pursuant to OCGA. Owners of vehicles that fit this category can use the DORs Title Ad Valorem Tax Calculator tool to calculate their.

Per the Georgia Department of Revenue Only the ad valorem tax portion of the annual auto registration can. 48-5C-1 created by HB 386 passed during the 2012. The Ad Valorem calculator can also estimate the tax due if you transfer your vehicle to Georgia from another state.

The millage rate is expressed as a multiple of 11000 of a dollar. Other possible tax rates in Georgia include. In 2013 Georgia created the Title Ad Valorem Tax or GA TAVT for vehicles purchased in March 2013 and later.

One salesman told me no because the trade in discount applies to purchases not leases. This tax is based on the value of the vehicle. Non-titled vehicles and trailers are exempt from TAVT but are subject to annual ad valorem tax.

The title tax law is codified in OCGA. As of 2018 residents in most Georgia counties pay a one-time 7 percent ad valorem tax on these vehicles at the time of purchase. This calculator can estimate the tax due when you buy a vehicle.

Can the Trade In Value of the Car be used to Reduce Title Ad Valorem Tax TAVT amount in Georgia. My trade in would be about 10k 700 credit toward TAVT which would be a nice compromise vs the money I lose selling it. If I itemize deductions on Federal Schedule A can I deduct my auto registration and ad valorem tax.

Another dealer said only partially. In the state of ga. The authorities then use the valuations to set a tax rate and impose an ad valorem tax on the property owners.

The trade-in value of another motor vehicle will be deducted from the value to get the taxable value.

Best Sebi Registered Advisory Company Indore India Rudra Investment Investing Intraday Trading Investing Money

Georgia Vehicle Sales Tax Fees Calculator Find The Best Car Price

Bti 2022 Georgia Country Report Bti 2022

Georgia Sales Tax Small Business Guide Truic

Sales Tax On Cars And Vehicles In Georgia

Georgia Vehicle Sales Tax Fees Calculator Find The Best Car Price

Browse Our Example Of Tax Receipt For Donation Template

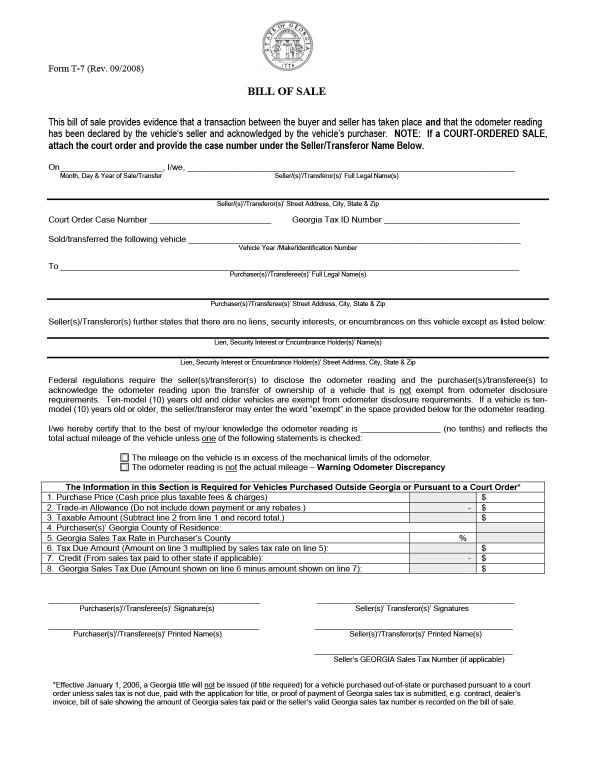

Georgia Bill Of Sale Form For Dmv Car Boat Pdf Word Best Letter Template Bills Doctors Note Room Rental Agreement

Denton Tx Homes Under 250k Biloxi Atlantic City Kahului

Infographic Which Countries Are Open For Business Business Regulations Business Infographic

This Tax Season May Be Over But What Should You Be Doing Now For The Next Llc Taxes Tax Deductions Property Tax

Georgia Bill Of Sale Templates For Autos Boats Firearm And More

The Ultimate Real Estate Investing Spreadsheet Real Estate Investing Investing Getting Into Real Estate

Karera Na Birzhe Kartinki 7 Tys Izobrazhenij Najdeno V Yandeks Kartinkah Yatirim Film Ekonomi

Georgia Used Car Sales Tax Fees

Hostess City Of The South How Do You Make A Game About The Great City Of Savannah Georgia While It S Impossible To Make A Game Outdoors Adventure City Games